Financial Lives After 50: Rethinking the Golden Years

Research presented by Financial Health NetworkRethinking the Golden Years

En español | 13 million of the more than 50 million low- to moderate- income (LMI) adults in America over 50 are considered financially vulnerable1.

“Financial Lives after 50: Rethinking the Golden Years” delves into the key financial decisions and vulnerabilities faced by the LMI 50+ population — in their own words — and examines topics such as work, debt burdens, medical shocks, multi-generation households.

1 according to data from the 2019 U.S. Financial Health Pulse Trends Report

Trailer

A lack of savings. Unmanageable debt. Increasing family responsibilities.Today, older Americans are experiencing increased demands on their time and money than prior generations.

Financial Lives After 50: Rethinking the Golden Years

A new series featuring real conversations to spotlight the financial needs of older adults.

Meet the Participants

-

Cathy W.

For Cathy, retirement looks far different than the one she imagined. The mother of five adult children lives with her 26-year-old daughter and 7-year-old grandson. Most mornings and afternoons, Cathy takes care of her grandson before leaving for her own job as a caregiver five nights a week.

-

Verner R.

Verner, a self-published author and former public television talk show host has had to focus on “stretching a dollar.” Even with a higher degree and award recognition for her show, she found it difficult to save her income as a single-mother raising four children.

-

Howard S.

Howard, a retired mail carrier, lives with his two adult sons, including his youngest son, a 42-year-old with mental and physical disabilities. While his home is paid off, increasing taxes and an additional life insurance policy that will help his son when he’s gone, means Howard has little leftover from his pension each month.

-

Joyce G.

Joyce lives in a bustling, tight-knit household with her son, daughter-in-law, brother and five grandchildren. The avid cook and hostess is working on becoming a rideshare driver in order to afford her blood pressure medication and put savings away for her own car.

-

Larry N.

Larry, a former bartender in the hotel industry, has had to come to terms with retirement and the loss of a steady income due to liver disease. He and his wife, Koren, are attempting to make the best of their golden years by enjoying their retirement community and relying on the kindness of neighbors.

-

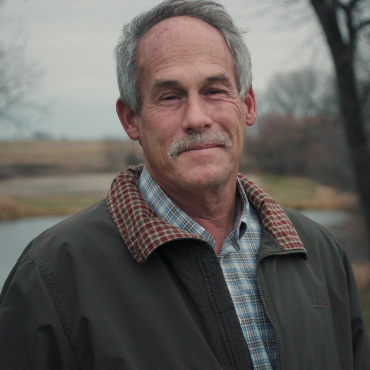

Ron E.

The 65-year-old lives with his wife, son and 5-year-old granddaughter in a multi-generational household. A cancer survivor and avid gardener, Ron takes his financial and health challenges in stride. Recently, he’s battled unemployment and savings shortfalls, but these obstacles have only made him more resilient.

-

Valerie W.

Finding love later in life was a blessing for Valerie, a 53-year-old resident of Eutaw, Alabama. But more than a decade later, Valerie finds herself as the main caretaker for her husband, a disabled Iraq War veteran who needs round-the-clock help.

-

Wilson F.

Living on a fixed income is quite difficult for Wilson, a 20-year resident of government housing in rural Alabama. Without a car, the 73-year-old has to rely on nonprofit services to get the groceries and medical care he needs. His favorite days are spent with friends barbecuing and watching a game.

-

Stephanie B.

Stephanie, a 51-year-old substitute teacher, prides herself on homeschooling her three children on their family farm in southern Iowa. She is a master of budgeting and stretching a dollar, especially when it comes to utilizing the produce from the garden.

-

Kathie A.

For Kathie, there is nothing better than living in rural Iowa and seeing deer run across the lawn of the home she shares with her husband. Money is tight but she prides herself on careful budgeting and prioritizing savings for upcoming expenses.

-

Paul D.

When the appliance manufacturing plant he worked at for 20 years closed, Paul decided to make farming his full-time job. Now at 66, the daily 5am wake up calls and recent injuries have made retirement an idea he can no longer ignore.

Meet the Experts

-

Lisa Marsh Ryerson

Lisa Marsh Ryerson is the President of AARP Foundation. A bold, disciplined and collaborative leader, she works to create and advance effective solutions that help vulnerable older adults increase their economic opportunity and social connectedness through programs and services that truly change lives.

-

Jennifer Tescher

Jennifer is the President and Chief Executive Officer of the Financial Health Network, the nation’s authority on consumer financial health. She founded the Financial Health Network in 2004 and is a nationally known expert on building opportunities for financial health.

-

Arjun Kaushal

Arjun uses his various experiences in policy, entrepreneurship and financial services to support research and financial technology engagements. Previously, he worked at the Aspen Institute and supported policy initiatives on consumer debt, long-term savings and retirement and financial wellness programs.

-

Andrew Dunn

Andrew designs research initiatives, analyzes data, and reports findings. Most recently, he co-authored Redesigning the Financial Roadmap for the LMI 50+ Segment: New Challenges and Opportunities, research that looks at the financial struggles of lower-to-moderate income Americans over 50.

-

Alice Rodriguez

Alice Rodriguez is the Head of Community and Business Development for the Consumer Bank. She is responsible for helping to drive the growth and profitability of a portfolio of approximately $2B in revenue, and comprised of a national customer base of over ten million households.