Lesson 3: Transferring funds and sending money using fintech

Transferring money is easier than ever these days thanks to financial technology – or fintech – apps and services.

And you may have plenty of reasons to send money quickly. Perhaps you’re out at lunch with a friend and you need to split the restaurant bill, or reimburse the person who paid. Or maybe your child, nephew or grandchild lives in another city and could really use some cash.

Whatever the reason, it’s common to want to send money in a speedy, efficient manner.

You may also need to transfer money from one of your bank accounts to another account, and do so outside normal banking hours.

Thankfully, making financial transfers and sending money to others – just by using your mobile device – is now a breeze.

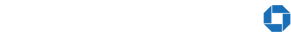

The easiest way to get it done may be using your banking app.

In addition to offering a consumer banking app, many banks participate in peer-to-peer payment services to let you send and receive money from others using just their mobile number or email.

A few examples and some highlights:

Square’s Cash App lets you send money to and from debit cards by sending an email or by using an app. Your debit card gets charged so the money is withdrawn from your checking account, and your recipient receives a credit to his or her debit card. Transfers take several days, and the service is free.

Facebook Messenger may be familiar to those of you who use the social networking service to chat with family and friends. But you can also use Messenger to send money to relatives online at no charge using a debit card.

PayPal requires users to sign up for their service, create a password, and link bank accounts. Transfers are free if they come out of your bank account or PayPal balance.

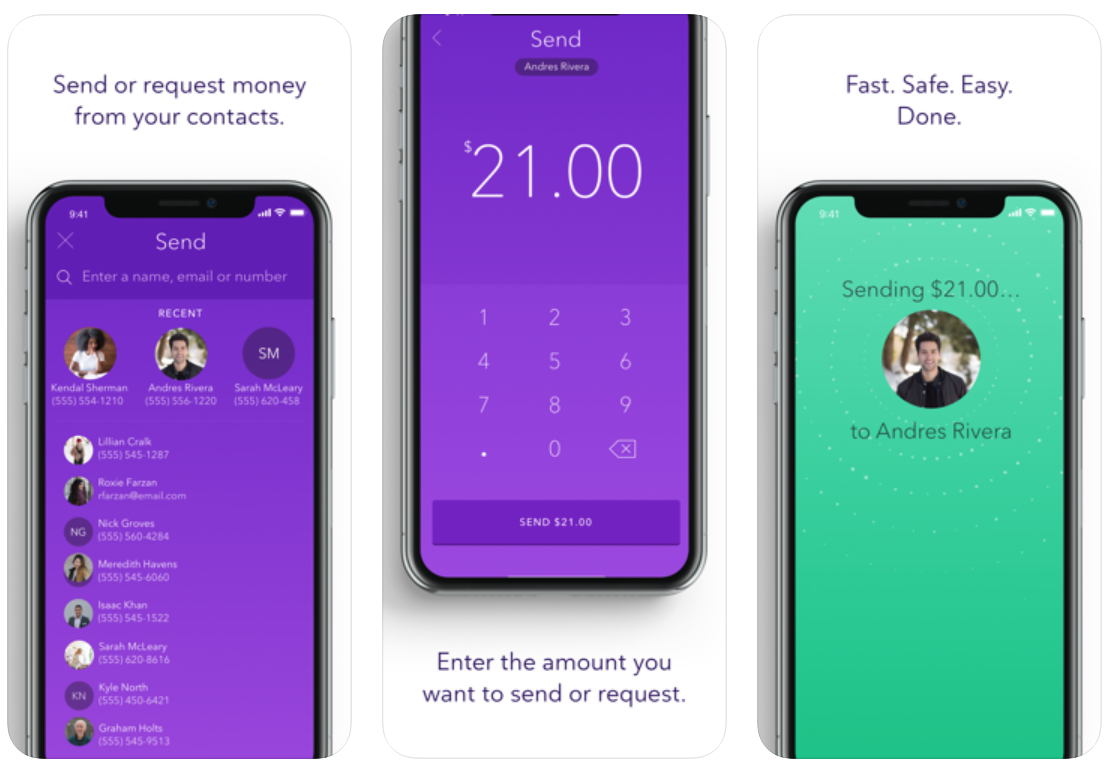

Venmo, a service owned by PayPal, is a free payment app that taps funds from your bank account or debit card. In addition to sending money, you can include a message with your payment.

Zelle allows you to send and receive money just by syncing your contacts from your mobile phone, right in your banking app. Plus, you can split the bill, and set up future and recurring payments to virtually anyone.

To send funds using the payment services referenced above, you and the recipient usually both need to have an account with the service provider.

Read more and watch the video below to get step-by-step instructions on exactly how to make financial transfers using your smartphone or tablet.

-

Download the right app

To make a digital money transfer, start by downloading your bank’s app or visit the App Store or the Google Play Store to download a third-party app like Cash App, PayPal or Venmo.

Using Chase QuickPay with Zelle you can “send money,” “request money” and even “split money” when you’re sharing a bill with someone.

-

Link your account

To perform a financial transfer, you must link your preferred bank account, such as your checking or savings account. To do this, you’ll need to provide some information, such as your phone number, email address, bank account number and Social Security number. Stay near your phone or computer in case you need to verify your identity via call, text or email.

-

Choose the recipient account

You can use your bank’s app to transfer money between your own financial accounts. But you can also use a third-party app, like Venmo, to send money to another individual.

Decide which method is most convenient for you and the recipient.

-

Enter the recipient’s information

To transfer money among your own financial accounts, your bank app will require you to select the account from which money is being taken — and the account into which you’re making a deposit.

If you’re sending money to someone else, using a third party app, you’ll need the recipient’s username, phone or email address. Enter this info, and simply hit send to complete the transfer.